Introducing the IRA Bonus Mapper

Do YOU qualify? Federal government giving out billions in clean energy funding and some communities get extra credit.

Tansy Massey-Green and Sujata Rajpurohit

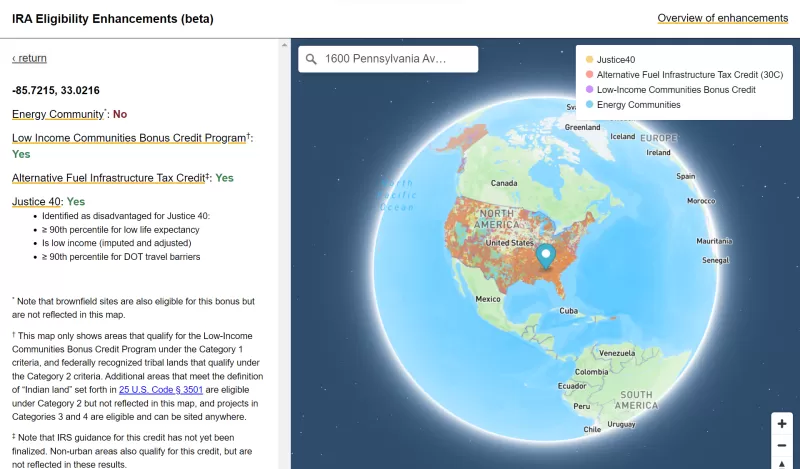

The federal government gives out money for climate, with some communities eligible for enhanced funding – this tool makes it easy to see if you qualify for these bonus credits

Just over a year ago, the US saw the biggest federal investment in clean energy and environmental justice in our nation’s history. Between the Infrastructure and Investment Jobs Act (IIJA) and The Inflation Reduction Act (IRA), billions of dollars are going out to states, cities, businesses, and nonprofits in the form of tax credits, grants, and low-cost financing to advance climate priorities and ensure the benefits are going towards disinvested communities.

Navigating all of these credits is difficult, especially since some of the tax credits and grants offer bonus funds or preferential treatment to projects in specific locations. For example, the Investment Tax Credit (ITC) and the Production Tax Credit (PTC) have credit bonuses for projects located in “energy communities” or “low-income communities.” Justice40 aims to direct funding to census tracts identified as “disadvantaged” by the Climate and Economic Justice Screening Tool.

Fortunately, America Is All In created a tool for users to find out which bonus provisions they’re eligible for by bringing together guidance from three federal tax credits into one simple map. Below are descriptions for each of the programs included in the tool. Check out the tool and see if you’re eligible for one of these enhancements here.

Clean Energy Tax Credits: Investment Tax Credit (ITC) and Production Tax Credit (PTC)

The ITC and the PTC provide tax credits for constructing new clean energy projects such as wind and solar, and accompanying storage. The ITC is a tax credit based on the clean energy system’s upfront cost and does not vary by system performance. The PTC, on the other hand, is a tax credit that a project owner will receive over a 10-year period based on the electricity project rate.

Tax eligible and tax-exempt entities (via direct pay) may choose to receive either the ITC or the PTC, but not both. When deciding which credit to choose, project owners should consider the size of the project, the amount of sunlight or wind available, and whether the project is eligible for any bonus tax credits. See more information on the ITC and the PTC here.

Aside from the low-income tax credit, these tax credits and bonuses are guaranteed if the project owner meets the requirements. Some requirements are action- and material-based, while others are location-based. Use the mapping tool to see if you automatically qualify for the location-based bonuses.

* Eligibility for portions highlighted in yellow can be determined using the mapping tool

Investment Tax Credit (ITC)

The ITC provides up to a 70% tax credit to tax-eligible and tax-exempt entities for upfront installation costs of clean energy projects. Eligible projects include solar, wind, ground source heat pumps, battery storage, and more. The funding structure is as follows:

- 30% base: For projects with capacity greater than 1 megawatt, the base rate begins with a tax credit of 30% of upfront costs if the prevailing wage and apprenticeship requirement is met. The prevailing wage requirement refers to minimum wage rates paid to workers, and the apprenticeship requirement refers to a percentage of work performed by qualified apprentices. If prevailing wage and apprenticeship requirements are not met, the base rate decreases by 80%. For projects less than 1 megawatt, the base rate is always 30% and prevailing wage and apprenticeship requirements do not apply.

- +10% for domestic content: Projects that source materials domestically will receive an additional 10% bonus. This means that products that are primarily made of steel and iron must be 100% produced in the US. In addition, a percentage of manufactured products must also be produced in the US. The percentages are as follows:

o 40% for projects that begin construction before 2025;

o 45% for projects that begin construction in 2025;

o 50% for projects that begin construction in 2026; and

o 55% for projects that begin construction after 2026.

Starting in 2024 tax-exempt entities MUST meet the domestic content requirement to qualify for direct pay, or face declining baseline tax credit values. A direct pay project starting construction after December 31st, 2025 that doesn’t meet domestic content requirements will receive no tax credit payments for the ITC or PTC. Projects that do meet the requirements receive both the 30% base and the 10% bonus. If prevailing wage and apprenticeship requirements are not met, the value of this bonus decreases by 80%. Neither domestic content credit reductions nor prevailing wage and apprenticeship requirements apply to projects less than 1 megawatt.

- +10% for energy communities: Projects in energy communities will receive an additional 10% bonus. If prevailing wage and apprenticeship requirements are not met, the value of this bonus decreases by 80%. An energy community is defined as (1) a brownfield site, where hazardous substances, pollutants, or contaminants are found; (2) a community historically dependent on fossil fuels for jobs and tax revenues; and (3) a census tract in which a coal mine or coal-plant has recently retired. Eligibility for criteria 2 and 3 are indicated in the mapping tool. Because brownfield sites are not included in the mapping tool, even if the tool says a project is not located in an energy community it may still be eligible for the energy community bonus if it’s located in a brownfield site. See here for more information on brownfield eligibility.

- + 10-20% for low-income projects: Solar and wind projects less than 5 megawatts located in low-income communities or on “Indian land” as defined by 25 U.S. Code § 3501(2) are eligible for an additional 10% bonus. The mapping tool will indicate if the project address is located in a low-income community or on certain federally recognized tribal lands. Projects where more than 50% of benefits go towards low-income households, and projects sited on buildings that are part of federal affordable housing programs are eligible for another 10% bonus on top of that. However, projects do not automatically receive the additional low-income credit. Project owners must request an allocation from the IRS during the application window and if awarded, place the facility in service within four years of receiving the allocation. See here for more detail.

These credits stack, which means that if a project is eligible for all of these credits, it would receive a tax credit for 70% of the upfront cost. If a project qualifies for some of these bonus credits, it could still receive a tax credit of 40-60% of the upfront project cost. For example, if a project follows prevailing wage and apprenticeship requirements to qualify for the 30% base credit and is located in an energy community for an additional 10% credit, the project is eligible for a 40% tax credit of its eligible costs.

Production Tax Credit (PTC)

The PTC provides a tax credit over a 10-year period for tax eligible or tax-exempt entities based on the clean electricity produced. Eligible projects include solar, wind, landfill gas, hydroelectric, and more. The tax credit is based on energy production performance of the system over a 10-year period. The funding structure is as follows:

- Base Rate of 2.75¢/kWh: Projects seeking the PTC will receive a base rate of 2.75¢/kWh for the first 10 years of the system’s operation if prevailing wage and apprenticeship requirements are met. If prevailing wage and apprenticeship requirements are not met, the base rate and bonuses decrease by 80%.

- + 0.3¢/kWh for domestic content: See domestic content requirements in the ITC section above.

- + 0.3¢/kWh for energy communities: See energy community requirements in the ITC section above. Project owners can check energy community eligibility on the mapping tool.

Justice40

The Justice40 initiative aims to deliver 40% of the benefits of federal climate and clean energy investments to “disadvantaged” communities. It refers not to a single source of funding, but to a government-wide effort to direct resources to places that have experienced historic disinvestment. Over 400 programs across 26 agencies are part of this initiative, and the list is updated regularly. Census tracts are considered “disadvantaged” if they meet one of 30 indicators of need across climate vulnerability, energy, health, housing, legacy pollution, transportation, water and wastewater, and workforce development. All federally recognized tribal areas are eligible. As of the first phase of the initiative, over $92 billion in funding has been made available to these communities through both IRA programs and existing government initiatives.

In addition, the IRA includes an Alternative Fuel Infrastructure Tax Credit (30C) that offers businesses, local governments, and other tax exempt entities a tax credit equal to 30 percent of the cost of alternative refueling equipment up to $100,000 if prevailing wage and apprenticeship requirements are met (and 6 percent if they are not). Electricity, hydrogen, and natural gas are all considered alternative fuels. For individuals, the tax credit is worth 30 percent of the cost of refueling equipment up to $1,000. While guidance for this credit has not yet been finalized, the text of the legislation states that non-urban census tracts, as well as communities that meet the same income threshold used in the Low-Income Communities Bonus, will be eligible. As such, the IRA Bonus Mapper reflects areas that are likely to qualify for this tax credit based on the income threshold.

---

Disclaimer: The mapping tool is for informational purposes only and may not be relied upon by taxpayers to substantiate a tax return position or for determining whether certain penalties apply and will not be used by the IRS for examination purposes. The mapping tool does not reflect the application of the law to a specific taxpayer's situation, and the applicable Internal Revenue Code provisions ultimately control.

Latest

More articles >